Introducing Napier v2: The Modular Yield Tokenization

Introduction

Today, we are excited to announce the initial release of the Napier Finance v2. This marks the first milestone towards the vision of a modular yield tokenization protocol that enables scaling beyond the existing DeFi market and alignment for anybody.

The Napier v2 protocol is a neutral coordination framework that introduces novel primitives for modular scaling, enabling users to fix, trade yield and build without limits on the Ethereum Virtual Machine.

The protocol is implemented as immutable smart contracts, designed to function as a trustless base layer for users, applications and beyond. Napier v2 is licensed under GPLv3 which you can find github.com/napierfi/napier-v2 (It’s not public yet). Once deployed, Napier will function in perpetuity, provided the existence of the Ethereum blockchain.

This focus brings unique benefits to Napier participants:

- Flexibility through Modularity: Curators (market owners) control and provide every aspect of yield tokenization—supported yield assets, maturities and caps, business model adjustments, behavioral economics mechanisms, single or multiple authority delegation, emergency stop mechanisms, and more. Any participant can freely join or opt out of the PT/YT ecosystem in Napier v2 under their own economic reasoning.

- Risk Minimization through Immutability: An immutable core contract on the Ethereum Virtual Machine removes external governance risk and single points of failure. A minimal yet flexible design further reduces risk.

- Active Ownership: Beyond autonomous software extensibility, achieving real scale and adoption requires active ownership by each participant. Napier v2’s economically and permission-wise divisible software makes this possible.

The Power of Modularity

Modularity is becoming mainstream in non-custodial finance. Lending (Morpho/Euler v2/Silo v2), staking (Symbiotic/Mellow), DEXs (Uniswap v4/Valantis), and LaunchPads (Fjord) are prime examples—essentially, “coordination frameworks.”

While permissionless infrastructure drives exponential growth, it isn’t enough on its own. Users want feature-rich products, so a “platform” that promotes active participation from those delivering these features is needed.

From this perspective, modularity could be the only viable approach that can withstand an exponentially growing market and user base without compromising scalability.

Scaling Crypto

One framework for thinking about how to scale crypto projects and something that justifies or validates our approach is through "contract theory." According to contract theory, "except for very simple contracts, all contracts are incomplete." This means that, given the complexity and dynamic changes in the world where contracts exist, it is nearly impossible to predict all the outcomes or behaviors of people involved in a contract.

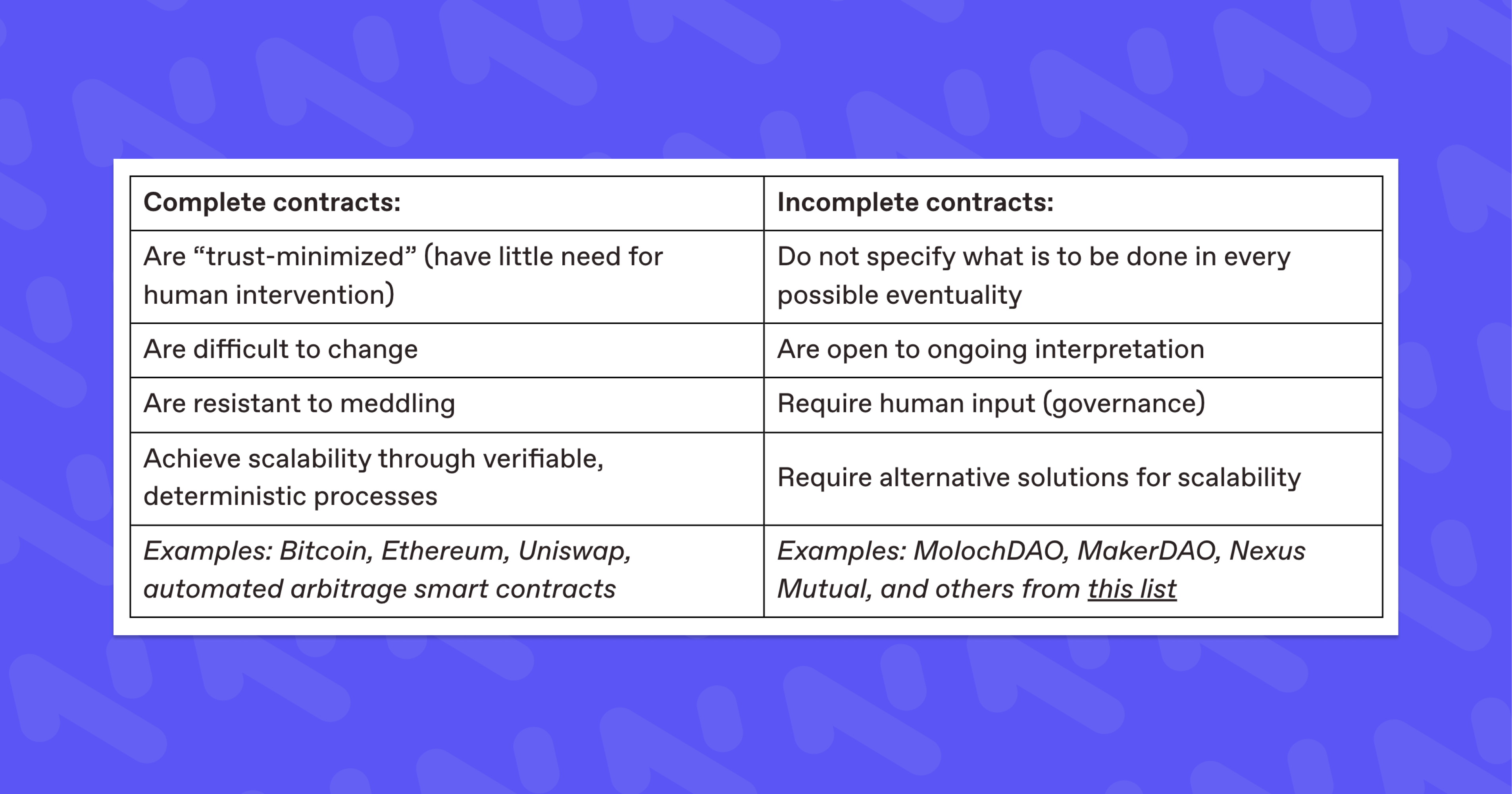

If we consider a "contract" as simply a decision-making logic, contract theory can provide insights into the nature of various types of smart contracts and crypto projects. These can be classified into two types of contracts: 1) complete contracts and 2) incomplete contracts.

- Complete Contracts: Autonomy and completeness are strongly correlated. Complete contracts can provide a software with limitless scalability. However, because it is impossible to predict every possible outcome or people's sequence of actions, it is nearly impossible to make all contracts fully complete.

- Incomplete Contracts: In contrast, incomplete contracts do not clearly define what should be done in all possible scenarios. Instead, they rely on ongoing (legal) interpretation to address any emerging cases from the present to the future. However, this undermines the scalability of automated software, and to compensate for this, organizational and economic catalysts are needed.

To recap, while it is not possible to fully resolve the "completeness" of all contracts independently, complete contracts are highly useful for the exponential scalability of software. On the other hand, incomplete contracts can adapt to change, but since they lack scalability through automation, they require organizational and economic catalysts to supplement them.

Problem: Unscalable Yield-Tokenization Model

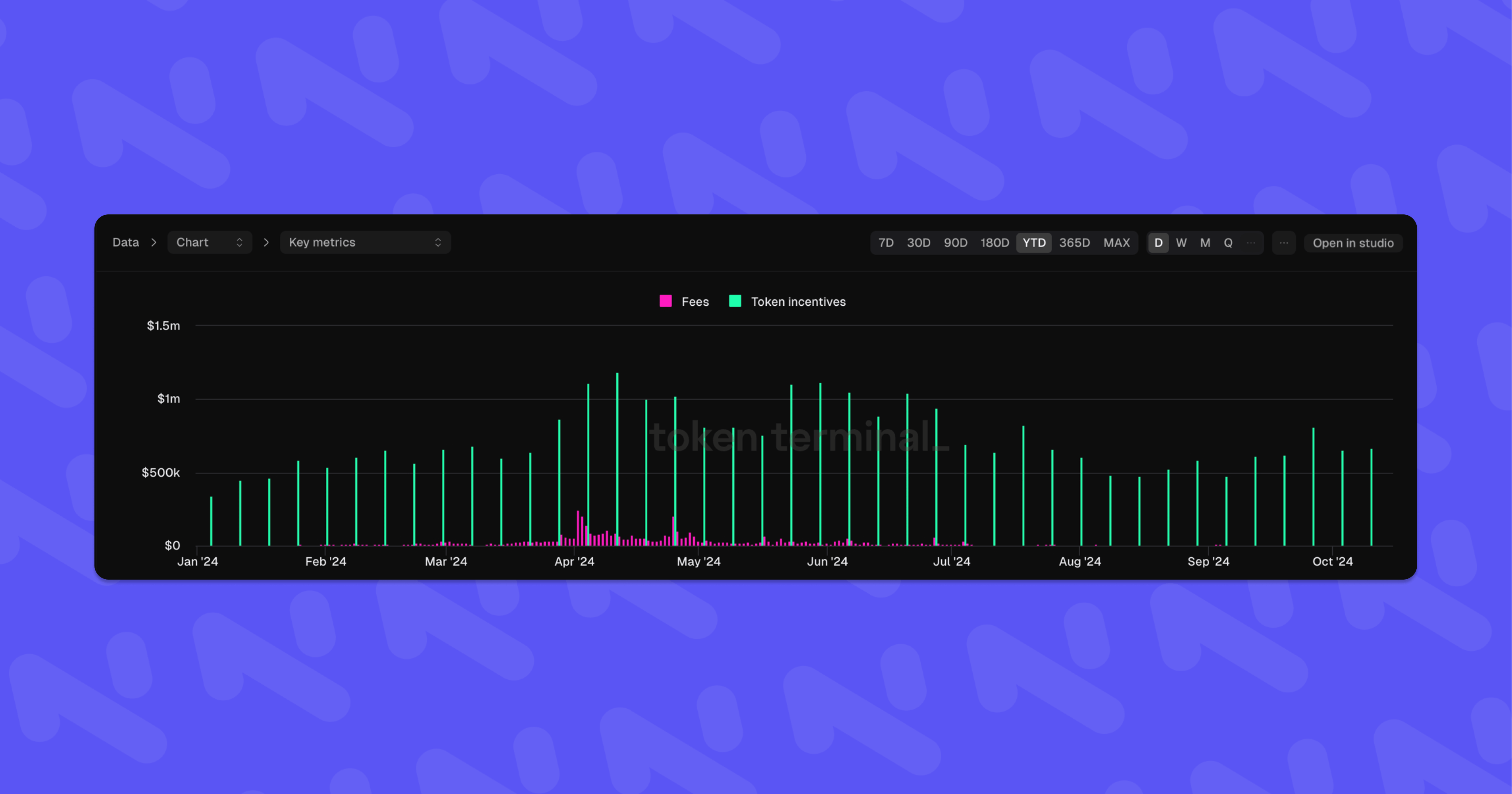

We must acknowledge Pendle’s relative success, where the core team manages many aspects of a complex product. Their approach was excellent for going from $0 to $10B. However, many projects are overwhelmed by their development backlog, risk analysis, and business operations, with too little authority or economic incentive to fix these issues. In addition, a closer look at fees and incentives reveals a flawed incentive structure. Notably, it is worth noting that incentives provided by external projects are essentially expenses in accounting for the providers themselves.

As the market and user base grow, the rising workload and costs for management highlight structural flaws that limit scalability.

Yet, simply building permissionless infrastructure doesn’t solve the problem since users always seek feature-rich and efficient products.

For example, Pendle is already permissionless at the contract level, allowing anyone to create their own market, but the fact that its UI isn't yet permissionless demonstrates this limitation. They plan to make the UI permissionless as well, but it's extremely difficult for pool creators to properly meet all user demands by determining factors like yield ranges and initial implied APY due to limited experience and information. If more complex DeFi integrations are involved, it's even more challenging.

The platform must encourage active and ongoing participation from contributors who can comprehensively meet these users' needs.

Additionally, from another perspective, not allowing permissionless listing has its benefits, as it enables resources—such as incentives, education, social attention, and BD efforts (e.g., lending listings)—to be concentrated on high-market-cap assets like PT-sUSDe, improving metrics such as TVL.

Therefore, a behavioral economics framework is needed to resolve misalignments between users, curators (market owners), and platform scalability, and to design their interactions— Napier v2.

Solution: Scalable Yield-Tokenization Model

The Napier v2 protocol is a neutral coordination framework for yield tokenization, designed with contractual, organizational, and economic modularity for maximum scalability. It’s similar to Pendle Finance, offering a comprehensive set of yield products but with one key difference: curators (deployers of PT/YT and related tech) retain ownership and can freely provide any yield product for yield-bearing assets without ignoring user demand.

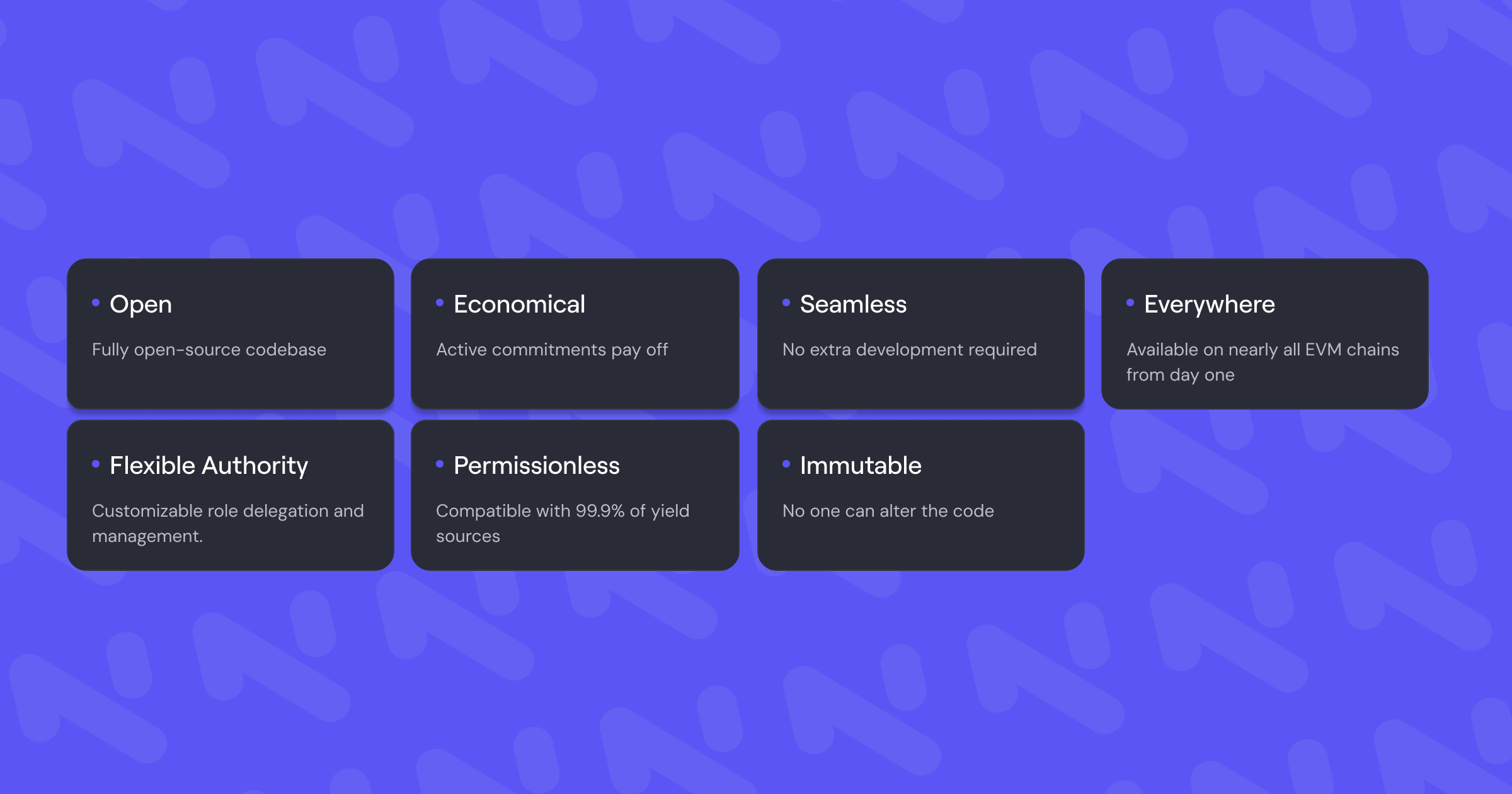

This creates a powerful foundation that is:

- Open: Fully open-source codebase

- Permissionless: Compatible with 99.9% of yield sources

- Immutable Options: No one can alter the code

- Seamless: No extra development required

- Economical: Active commitments pay off

- Flexible Authority: Customizable role delegation and management per module

- Everywhere: Available on nearly all EVM chains from day one

With these features, we believe that the Napier v2 could be one of the few approaches to address the limitations our competitors are facing and achieve unlimited scaling.

Anyone can build Pendle or Spectra with Napier v2, but not the other way around. Napier v2 is designed to be an unopinionated platform.

Napier Protocol V2

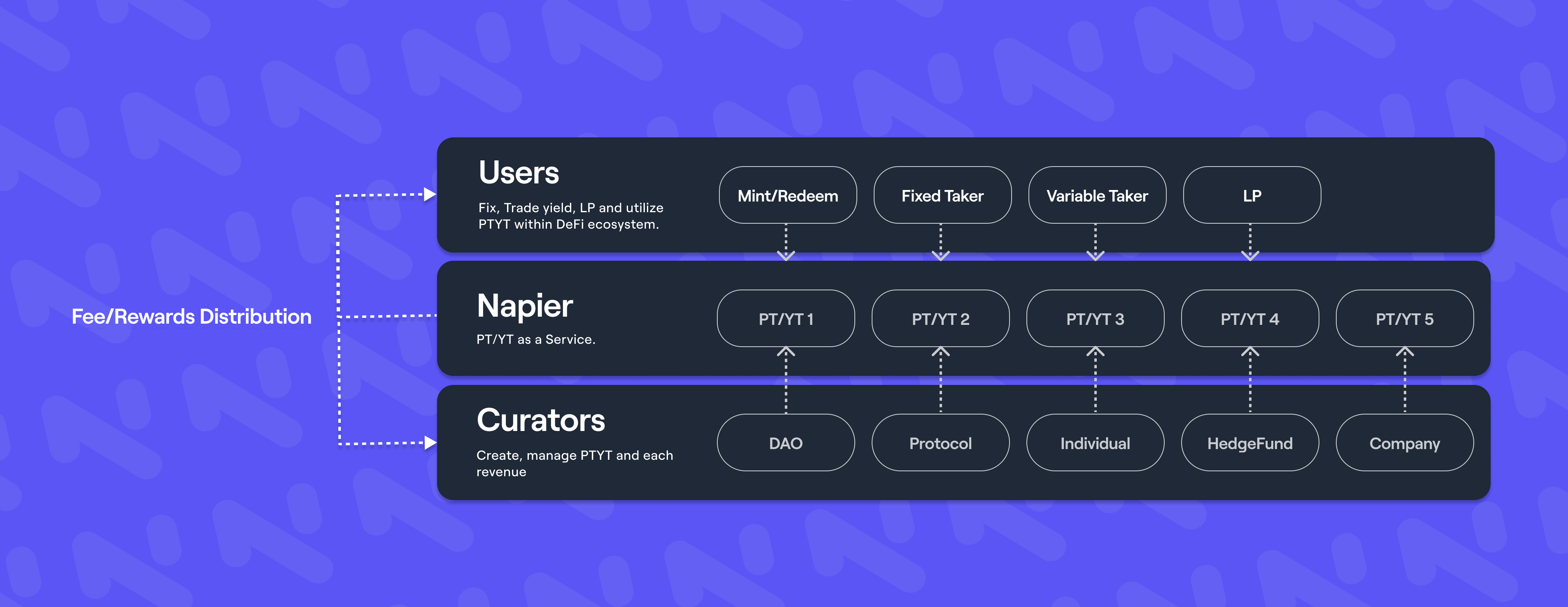

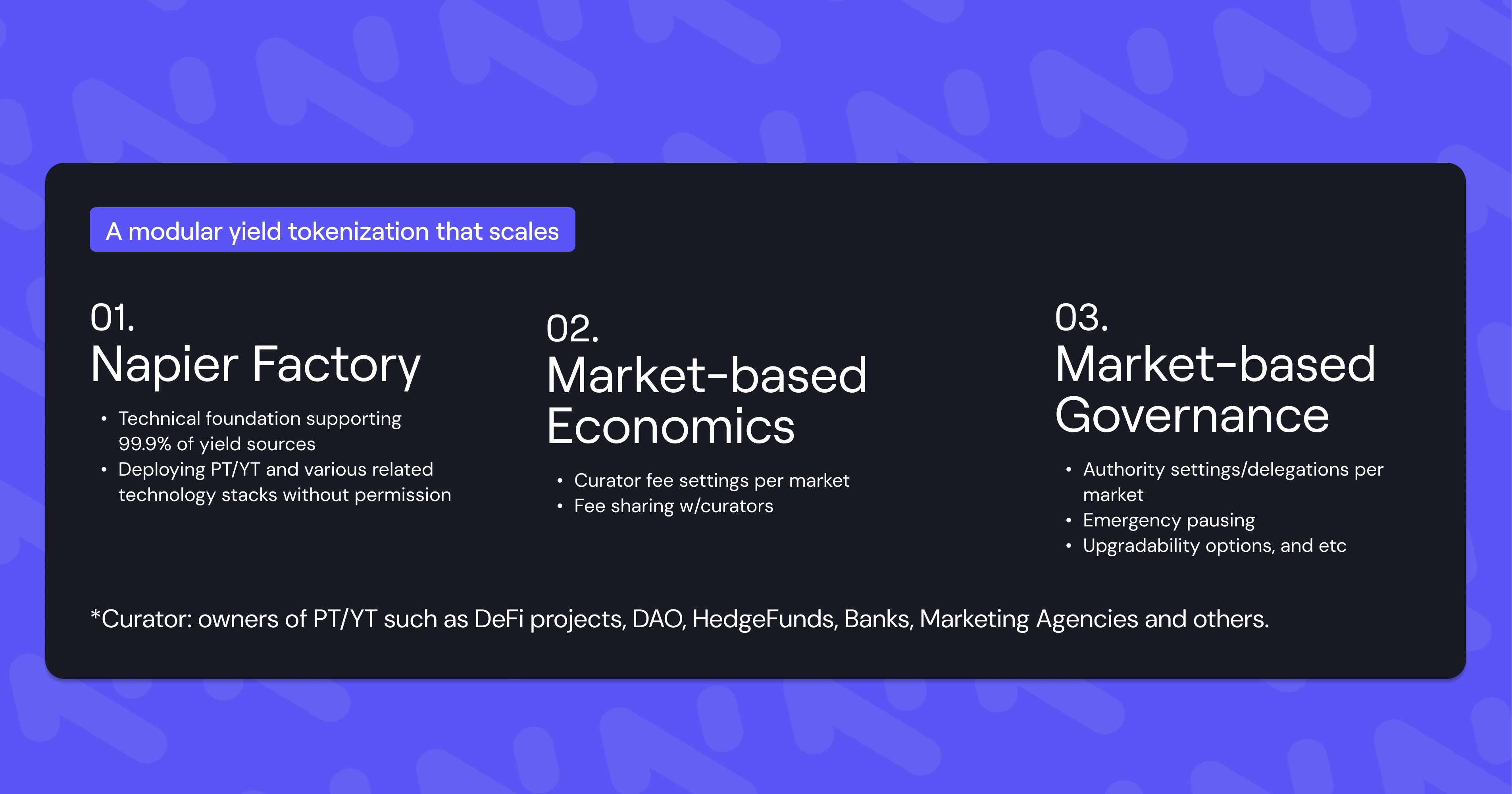

The core of the Napier v2 Protocol is a comprehensive technical kit that is an interface allowing anyone to freely deploy PT/YT. It can be broken down into three perspectives:

- Napier Factory aka Curator Hub: Support 99.9% of yield sources, and deploying various related technology stacks without permission.

- Market-Based Economics aka Curator-Set Fee Model: Allows each market to customize its fee structure, promoting active ownership and participation.

- Market-Based Governance: Enables authority delegations, emergency pausing, and upgradability options, fostering active ownership.

Below, we explain these terms in more detail.

1) Napier Factory aka Curator Hub

Napier Factory provides a seamless, permissionless experience that lets anyone (curators) create PTs and YTs, and operate various related tech stacks:

- PT/YT creation

- Trading system deployment

- Lending system deployment

- Yield aggregator deployment

- More to come—endless possibilities

All of this is deployed through Napier’s Curator Interface.

2) Market-Based Economics aka Curator-Set Fee Model

On the Napier platform, anyone (curators) can define the economics for their PT and YT assets. This flexibility enables customization, allowing individuals and projects building on Napier to unlock a wide range of use cases.

Curator-Set Fee Model

This model is poised to become a new standard for yield tokenization in DeFi. Curators can choose from various fee types, set percentages, earn revenue, and assign attributes that best fit their PT and YT assets, such as:

- Issuance fee is a fixed fee applied when minting a new PT and YT.

- Redemption fee is a fixed fee charged when redeeming a PT and YT back into their underlying assets.

- Performance fee (before maturity) is a dynamic fee from all yield accrued (including points) by all YT in existence.

- Performance fee (after marurity) is a dynamic fee from all yield accrued (including points) by all yields from the YBTs of matured unredeemed PTs.

Fees for PT and YT should consider various factors, including the underlying yield-bearing assets, the PT/YT characteristics, and the broader market environment. For example:

- Set fees based on the volatility of the underlying assets.

- Use dynamic fees tied to interest rate volatility for fair pricing.

- Lower fees for PT/YT nearing maturity, as interest rate swings diminish.

- Adjust fees by maturity length; longer maturities may warrant higher fees due to greater interest rates.

- Impose post-maturity penalties on PT/YT to encourage rollovers.

Such flexibility aligns fees more closely with market supply and demand, resulting in more efficient markets.

Fee Distribution Ratio

The fee split between curators and users is determined via Napier governance. Until the Napier DAO is formed, Napier Labs will set the ratio after carefully considering the best incentive allocation for the ecosystem’s growth. However, the DAO’s formation isn’t too far off.

3) Market-Based Governance

Similar to market-based economics, any curator can flexibly assign various PT/YT-related roles to one or more individuals or entities. This governance flexibility enables quicker, non-arbitrary decision-making for those building with Napier.

In Napier v2, the following roles exist:

- Super Admin: Held by Napier Governance, owner of the Napier Protocol and Treasury.

- Treasury: Fee receiver of the Napier Protocol; collective financial resources for Napier Governance.

- Napier Developer: Developer multisig at Napier Labs.

- Fee Distributor: Distributes protocol fees.

- Fee Converter: Converts protocol fees.

- Protocol Fee Collector: DAO account for collecting fees.

- Curator: Owner of a specific PT, managing addition/removal of roles.

- Fee Manager: Account delegated by a Curator to set PT fees.

- Fee Collector: Account delegated by a Curator to collect PT fees.

- Fee Receiver: Individual or project delegated by a Curator to receive PT fees.

- Protocol Pauser: Account delegated by a Curator to pause a specific PT in emergencies.

Napier Labs and the Napier DAO have no authority over individual PT/YT. Instead, each PT/YT is governed by its own curator, who holds roles like Fee Manager, Fee Collector, and Protocol Pauser.

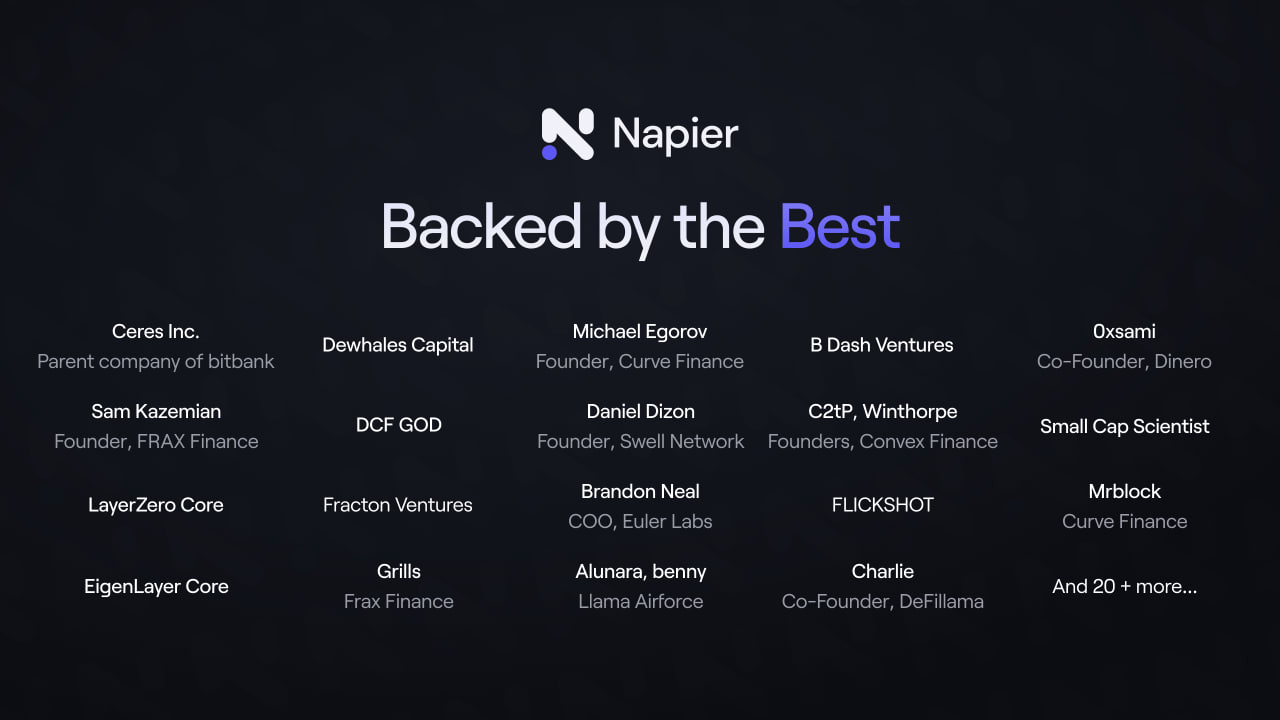

Backed by the Best

To further our mission, We are excited to have received financial backing from many who share our belief in the power of modular software.

We are excited to see and support what will be built on top of Napier’s PT/YT primitive. If you’re building a trust-minimized service and are aligned with our mission, please get in touch with our team to become our launch partners: forms.gle/drGWxczPoT98A6Xx7

Reviewed and Trusted Codebase by the Best

Security came first in every step of building Napier v2.

Napier v2 uses its own contracts and is built as a public financial infrastructure. We take security very seriously and have enlisted the best builders in the industry to protect your funds.

To enhance our security measures, we consulted Erik Arfvidson and Kasper Pawlowski from Euler Labs. They manage daily security operations at Euler Labs, allocated a $4M security budget for Euler v2, and collaborated with external security partners. Additionally, we worked with vectorized.eth, the developer of Solady—a library of optimized Solidity snippets—to improve our protocol’s architecture and gas efficiency.

We are committed to maintaining the highest security standards and have teamed up with leading auditors in the industry. Comprehensive security audits, gas/parameter optimization, code reviews, formal verification, and code competitions have been conducted by experts such as Cmichel (Spearbit), Cantina, Winney, yAudit, Michael Egorov, and many others to ensure your funds are well-protected.

Our commitment to security doesn't end here. As the launch of Napier v2 approaches, we'll reveal even more.

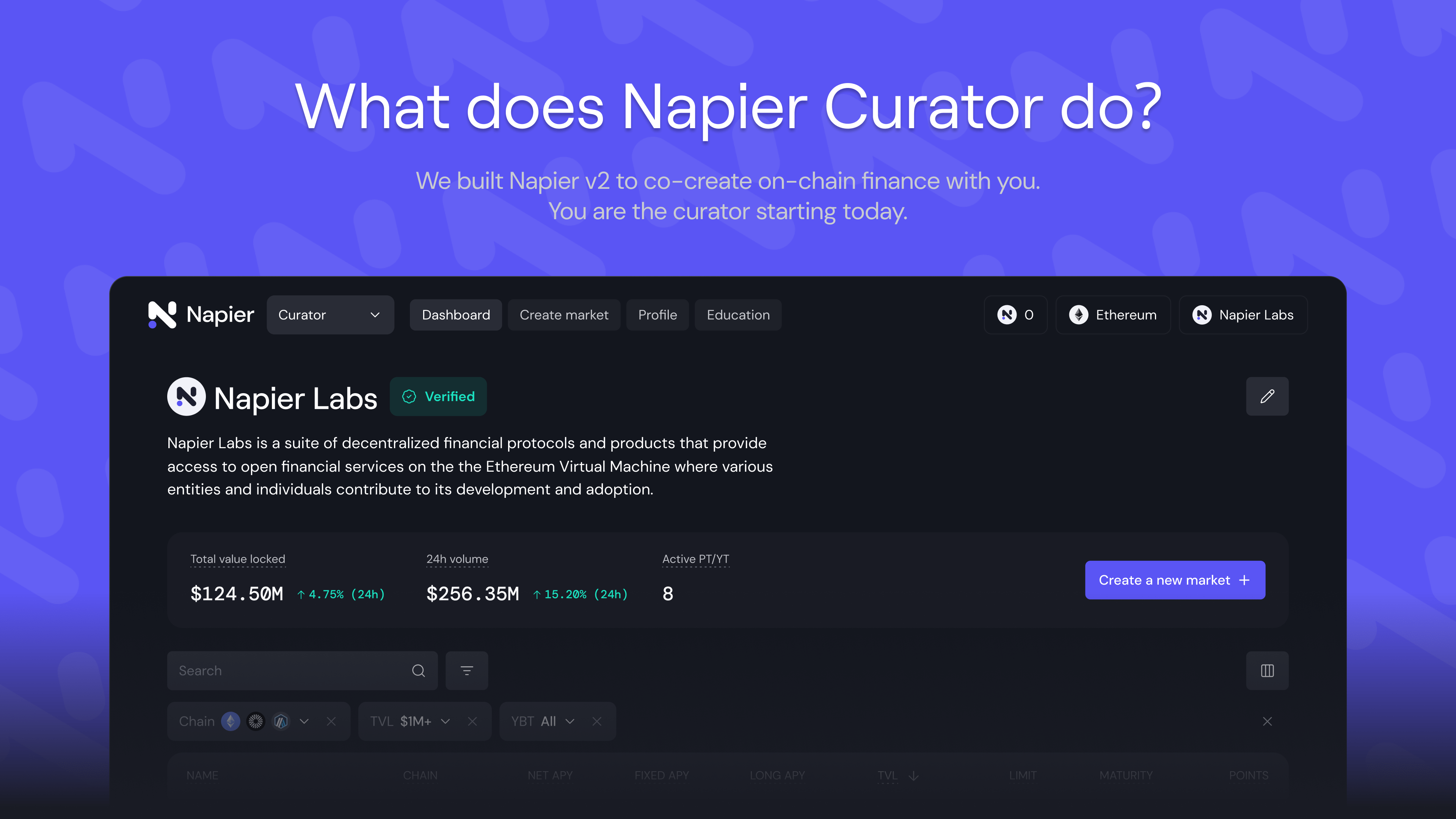

What the Napier Curator Does

We built Napier v2 to co-create on-chain finance with you. Anyone can become a curator by leveraging Napier v2’s infrastructure.

Here’s what’s mainly expected of Napier curators:

- Easily deploy Napier PT/YT using yield-bearing assets

- Manage the tech, BD, and marketing for PT/YT and its users

- Earn PT/YT revenue and Napier Points in return

- In the future (post–Napier Point), use $NPR to incentivize PT/YT for its users.

For example, consider these possible collaborations:

- Curve Labs: As a curator, created PT/YT with a Sept. 9, 2025 maturity using scrvUSD as the underlying asset. The Curve DAO address holds Fee Manager and Fee Collector roles, and the Napier Labs address holds the Protocol Pauser role.

- DeFimans (100% subsidiary under SBI Holdings): As a curator, created PT/YT with a Nov. 10, 2026 maturity using wstETH. Its own address holds Fee Manager and Fee Collector roles, while its address, Napier Labs, and several cybersecurity companies share the Protocol Pauser role.

- MEV Capital: As a curator, created PT/YT with an Apr. 30, 2025 maturity using eBTC (etherfi). Its own address holds Fee Manager and Fee Collector roles, and MEV Capital holds the Protocol Pauser role. They also deployed a Curve v2 trading system and a lending vault on Euler, both using PT-eBTC.

- Gauntlet: As a curator, created PT/YT with a Dec. 30, 2025 maturity using sUSDe (Ethena). Gauntlet holds the Fee Manager, Fee Collector, and Protocol Pauser roles. They also deployed a Uniswap v4 trading system and a lending vault on Morpho, both using PT-sUSDe.

- Yearn: As a curator, created PT/YT with a July 14, 2025 maturity using yETH (yearn). The Yearn devs’ multisig has the Fee Manager role, the Yearn DAO address is the Fee Collector, and the Protocol Pauser role is shared among the Yearn devs’ multisig, Napier Labs, and several cybersecurity companies. Later, one cybersecurity company went bankrupt, so its Protocol Pauser role was revoked.

- Dinero: As a curator, created PT/YT with an Aug. 21, 2025 maturity using ipxETH and Dinero’s branded LSTs. The Dinero DAO address holds Fee Manager and Fee Collector roles, while its own address, Napier Labs, LaserDigital, and Galaxy Digital share the Protocol Pauser role.

More scenarios are possible. Join our Discord and reach out to us!

Announcing the PT and YT Alliance

We’re excited to announce the launch of the PT and YT Alliance.

Napier v2 is designed for maximum flexibility and an open design space. The PT/YT in Napier v2 serves as a neutral, public financial framework—similar to ERC20 or ERC4626—that can be freely used by a wide range of builders.

Any economic entity—whether a company, DAO, DeFi project, or otherwise—can leverage the Napier v2 tech stack at any stage. From day one, anyone can launch a trust-minimized yield tokenization module or extend existing protocol contracts within their ecosystem. This expands utility and creates new revenue streams.

We’re thrilled to see how each part of the community-built Napier v2 process unfolds, in collaboration with builders and users alike.

The Road to NPR Tokens: Renewal of Napier Points

Renewal of Napier Points is on the horizon for both curators and users.

The Napier Point Program has been revamped to support the growth of Napier v2 and encourage sustained, active participation in the ecosystem. All Napier Points distributed up to v1 will remain with their respective users, and point distribution will resume with the launch of v2. Napier Points can be earned by using Napier v2 or participating in related activities as users or curators. By the time of the Token Generation Event (TGE), all distributed Napier Points will represent a significantly increased percentage of the total NPR supply, instead of the initially planed 3%.

More detailed information will be shared as the launch approaches.

You Curate Yield, Starting Today

Napier v2 addresses the limitations of stereotypical yield tokenization protocols, aiming to become the primary yield derivatives layer of onchain finance. The modular architecture enables scaling beyond the existing DeFi market and alignment for anybody, providing permissionless design space of PT and YT with economic and authoritative flexibility that seamlessly connects across the DeFi ecosystem. Yet, the best product doesn’t always guarantee the best outcome. Our journey has just started.

Starting today, you are a curator. Join the Napier discord to see what’s next!