Napier v2 is Live: Fix, Trade and Curate Yield

Napier v2 is here.

Following a year of meticulous development and rigorous security audits, Napier v2 is now live, accelerating the modularity movement in DeFi.

The Napier 2 is a modular yield tokenization protocol enabling users to fix, trade yield and curate any yield products on the Ethereum Virtual Machine. This launch represents a pivotal moment in DeFi. With Napier v2, the possibilities for fixed-yield lending, borrowing, leveraged yield trading, and building are significantly expanded.

Napier v2 is licensed under GPLv3 which you can find github.com/napierfi/napier-v2-public. Once deployed, Napier will function in perpetuity, provided the existence of the Ethereum blockchain.

The protocol is implemented as an immutable smart contract, designed to serve as a trustless base layer for users and applications while offering advanced customizability to accommodate future use cases.

TL;DR

- Napier v2 is rebuilt from scratch, now stronger and more refined.

- Officially live on March 17, across 10+ EVM chains.

- 50+ launch partners, offering diverse assets and DeFi integrations.

- Designed for rapid expansion from day one.

- Join, accumulate Napier Points, and earn part of 15% NPR supply.

- The first week of Napier Point distribution is from March 17th at 6 PM UTC to March 24th at 6 PM UTC, with 100 million Napier Points allocated.

Background: DeFi Becoming Backend

DeFi is shifting into a fully B2B2C backend model, with DeFi-focused hedge funds on the rise. The main focus now is creating foundational platforms that let fintech companies, hedge funds, and DeFi projects freely build financial products. Uniswap v4, Lido v3, Aave v4, Euler, Morpho, Mellow, Yearn v3, and Veda all embody this trend, integrating fintech and hedge funds as asset managers (curators) or enabling DeFi projects to build in-house solutions. This is expected to expand end-user options and benefits. The market climate is changing dramatically, and the entire DeFi ecosystem is undergoing renewal.

However, some sectors have yet to adapt to this shift—Yield Tokenization.

Problem: Unscalable Yield Tokenization Model

Pendle’s relative success is undeniable. Its core team’s approach to managing a complex product was highly effective, growing from $0 to $10 billion. However, exclusive management (self curation) by a core team or DAO for such a complex product does not scale. As the market and user base expand, the workload and costs grow, revealing structural flaws that limit scalability.

While permissionless products (i.e., non curation like Spectra) aid scalability, they are not sufficient on their own. Users still demand feature-rich, efficient solutions. Even combining the best of both doesn’t resolve the fundamental issue—there’s still a conflict of interest.

Thus, from both economic and governance perspectives, a solution is needed to resolve misalignments between users, curators (market managers), and the platform regarding scalability. This is where Napier v2 (“Crowd Curation”) comes in.

Solution: Napier v2 - The Modular Yield Tokenization

We are building a modular yield tokenization platform that gives you complete freedom to launch a feature set offering yield trading, fixed-rate lending, fixed-rate borrowing, and more.

It gives you the freedom to:

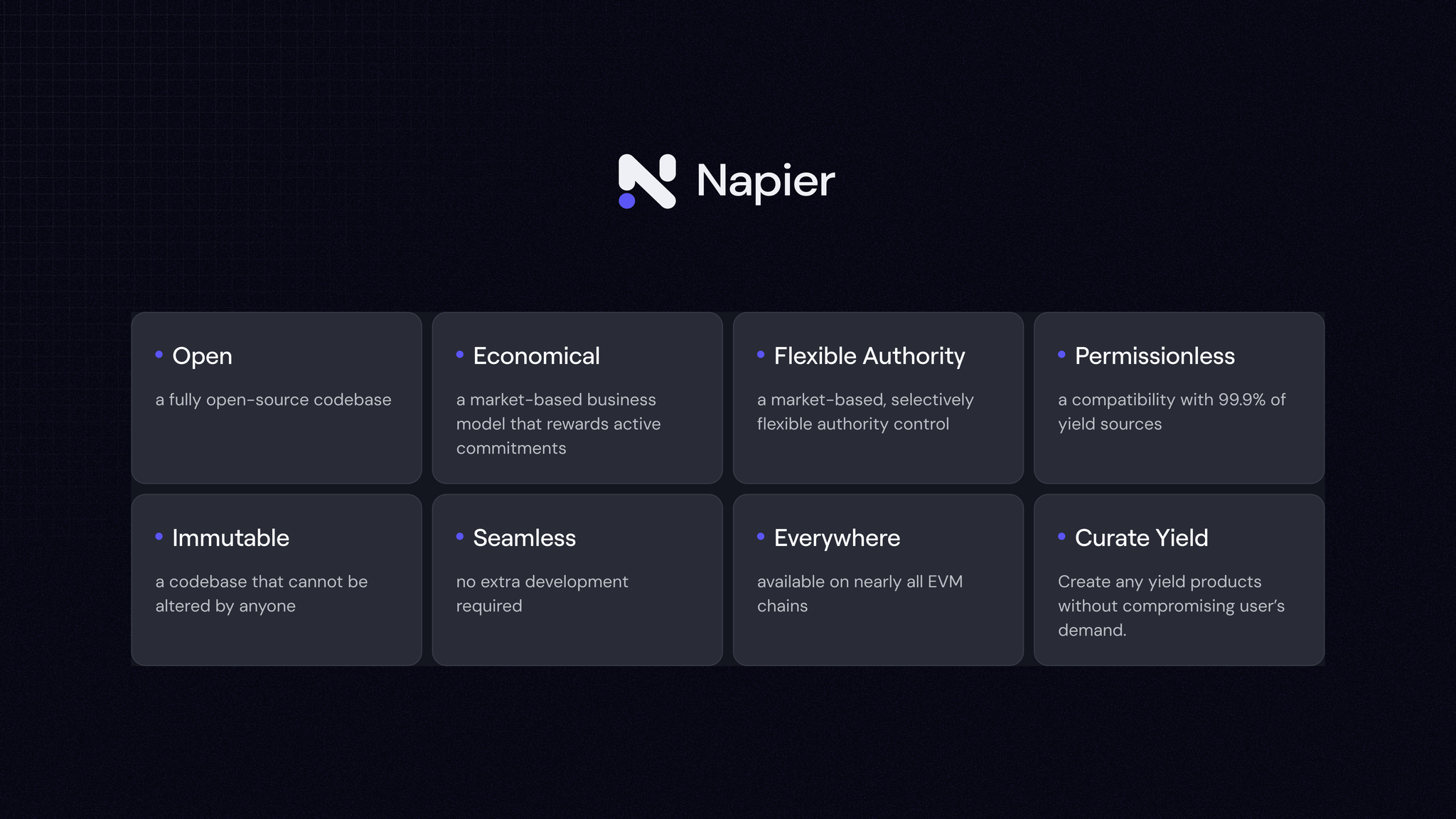

- Open: a fully open-source codebase

- Economical: a market-based business model that rewards active commitments

- Flexible Authority: a market-based, selectively flexible authority control

- Permissionless: a compatibility with 99.9% of yield sources

- Immutable: a codebase that cannot be altered by anyone

- Seamless: no extra development required

- Everywhere: available on nearly all EVM chains

Napier Labs, Napier DAO, Napier Foundation, and any related entities do not retain any special privileges within the protocol. Curators have full control over the markets they deploy—they manage them, define their economic models, and receive the revenue generated.

This design enables curators to adjust parameters, respond to crises, hacks, or volatility, and mitigate risks accordingly. Since governance over a market is not suitable for everyone, it remains entirely optional. During deployment, all privileges can be relinquished, making the system fully immutable ("Unstoppable").

Users who prioritize complete immutability benefit from full transparency but must acknowledge that they bear full responsibility for risk management in case of any issues. Others may opt for governance-enabled markets, where a trusted risk manager actively oversees risk mitigation.

Ultimately, your choice depends on your vision—powered by Napier protocol.

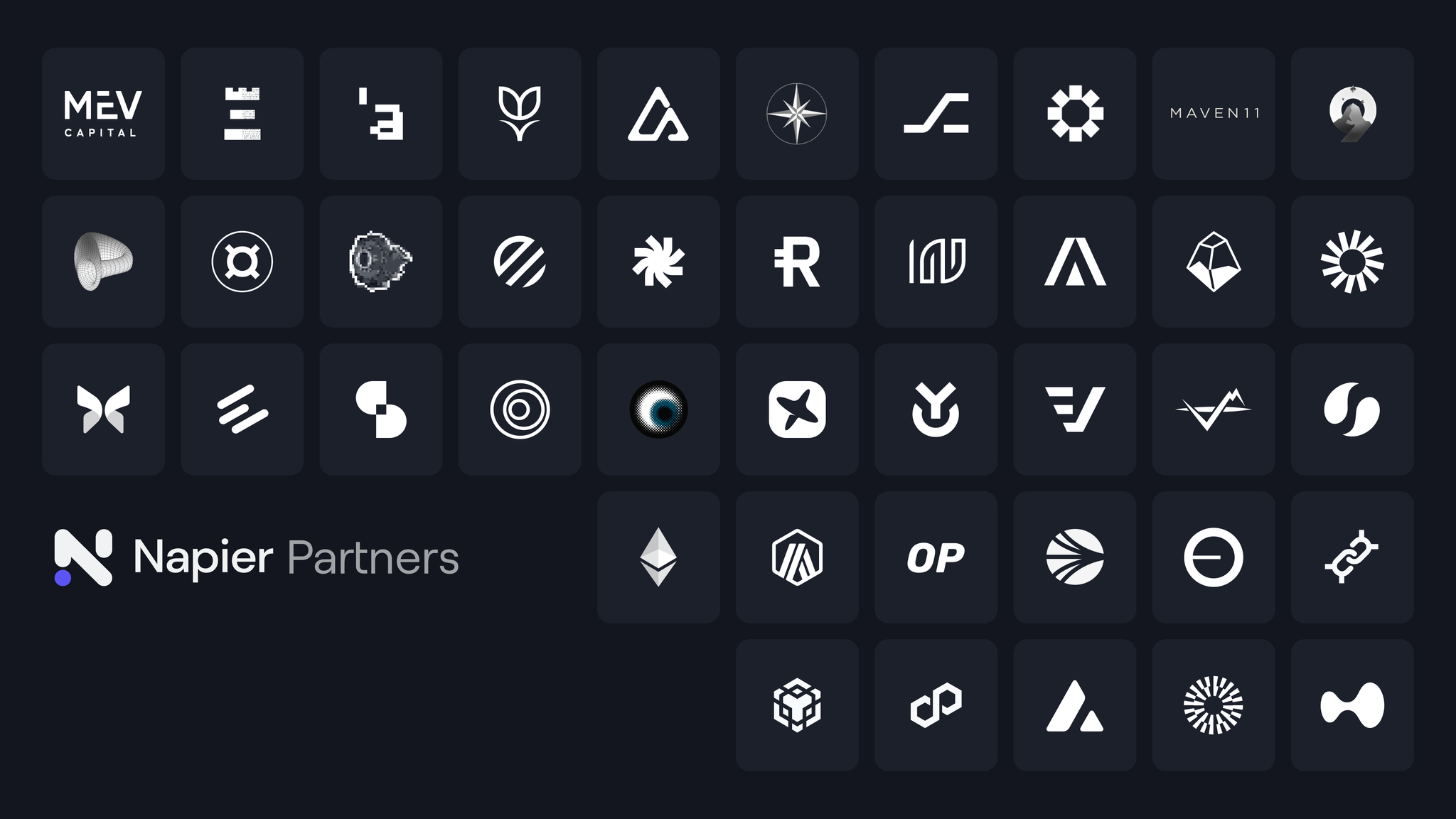

Announcing the launch partners

- Curator: MEV Capital, Re7 Labs, Apostro, Tulipa Capital, 9Summits, Alterscope, Maven 11, Tanken Capital, DeFimans, Nest Credit, Curve DAO, Yearn DAO, Euler DAO, Dinero, Frax DAO, Etherfi, PumpBTC, Renzo, ListaDAO, Superform, Reserve, Inverse, Avalon Labs, StakeStone and more.

- Lending and Borrowing: Morpho, Euler and Silo.

- (Re)staking: Mellow, Dinero and Inception.

- Vault: Yearn, Veda, IPOR and more.

- Chain: Ethereum, Arbitrum One, OP Mainnet, Sonic, Base, Fraxtal, BNB Chain, Polygon, Avalanche, Mantle, HyperEVM.

Napier Points

The Napier Points Program is designed to expand the Napier ecosystem and benefit all participants. It ensures that key contributors receive fair rewards for their efforts.

During the initial bootstrap phase, the goal is to rapidly expand available markets and investment opportunities while establishing Napier's crowd curation model as a mainstream standard.

To support this, 15% of the total NPR supply is allocated to Napier Points. Users and curators can earn points through the following activities:

- Becoming a curator and creating PT/YT markets on Napier v2.

- Providing liquidity to a pool and holding LP tokens (or staking them in a Curve Gauge).

- Purchasing or minting YT in a pool and holding it.

- Additional activities may be added in the future.

Napier Points are distributed weekly in fixed amounts, adjusted for ecosystem growth. The first week of Napier Point distribution is from March 17th at 6 PM UTC to March 24th at 6 PM UTC, with 100 million Napier Points allocated.

To learn more about our Napier Point, check here.

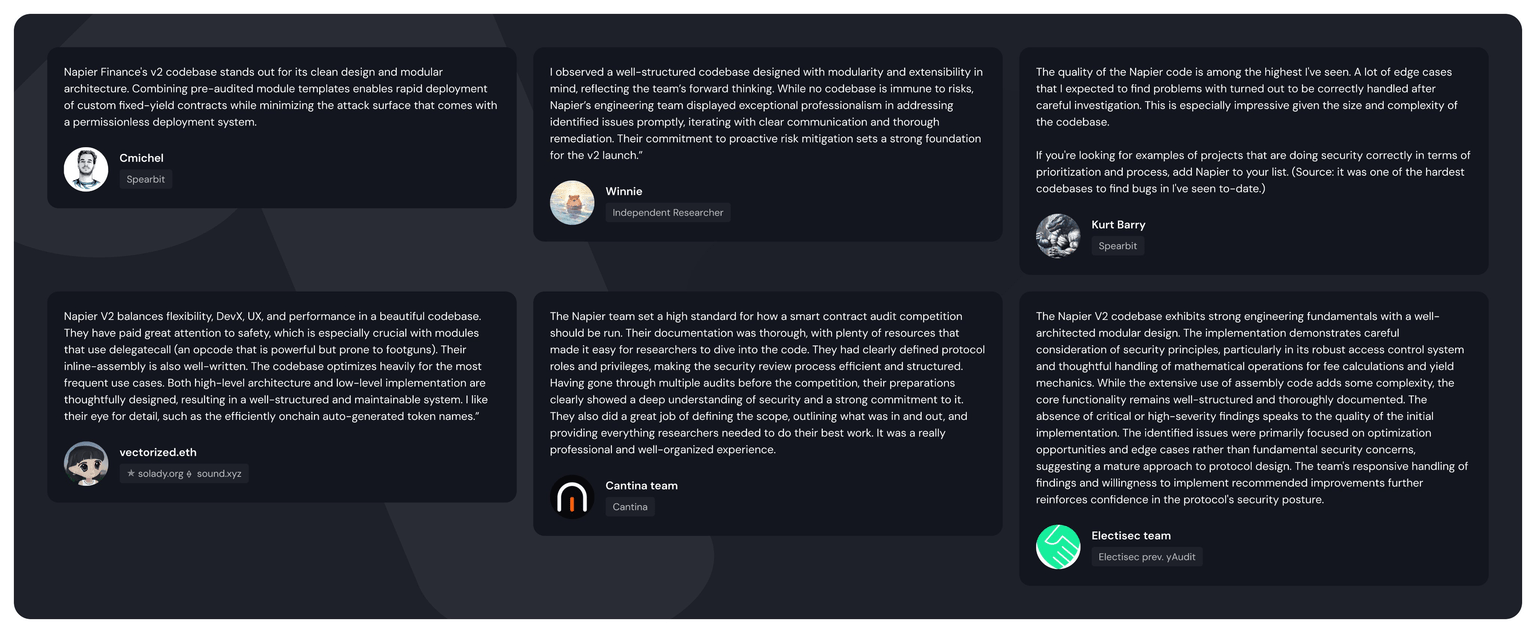

Security

Napier v2 uses its own contracts. We take security very seriously and have enlisted the best builders in the industry to protect your funds. To improve our security processes and operations, we sought advice from Erik Arfvidson and Kasper Pawlowski of Euler Labs. They are key figures in managing daily security operations at Euler Labs, where they allocated a $4M security budget for Euler v2 and worked closely with external security partners to oversee the security processes for Euler v2. Additionally, vectorized.eth was invited to improve the protocol's architecture and gas efficiency. He is known as the developer of Solady, a library of Solidity snippets optimized for proper gas usage. We are committed to security and have partnered with the industry's top auditors to protect your funds. Extensive security audits, code reviews, formal verification, and code competitions were conducted by industry leaders such as Cantina, Spearbit (Cmichel, Kurt), Winney, and yAudit.

To learn more about our commitment to security, check the article “Secuing Napier”.

A new era of onchain yield derivative

As of today, March 17, Napier v2 has officially launched, with many exciting developments and announcements ahead. Our ultimate goal is to establish DeFi as a truly public financial infrastructure.

Napier v2 is not just a yield trading protocol—it is a public financial framework that provides the foundational infrastructure for the on-chain finance yield layer. With Napier v2, builders can create and optimize PT and YT to suit any strategy or need. From passive yield aggregators to complex yield management systems, the possibilities are endless.

Starting today, you curate yield. Visit app.napier.finance to start.