Today we unveil Napier AMM—a bespoke liquidity engine for yield trading, built to scale on-chain interest-rate derivatives to trillion scale. Carrying forward Napier v2’s design ethos, it combines Just-in-time liquidity, rehypothecation of LP funds, curator-defined parameters, concentrated liquidity, and time-adaptive curve tuning—delivered as a Uniswap v4 Hook with a Notional-style custom curve.

The Journey to Napier AMM

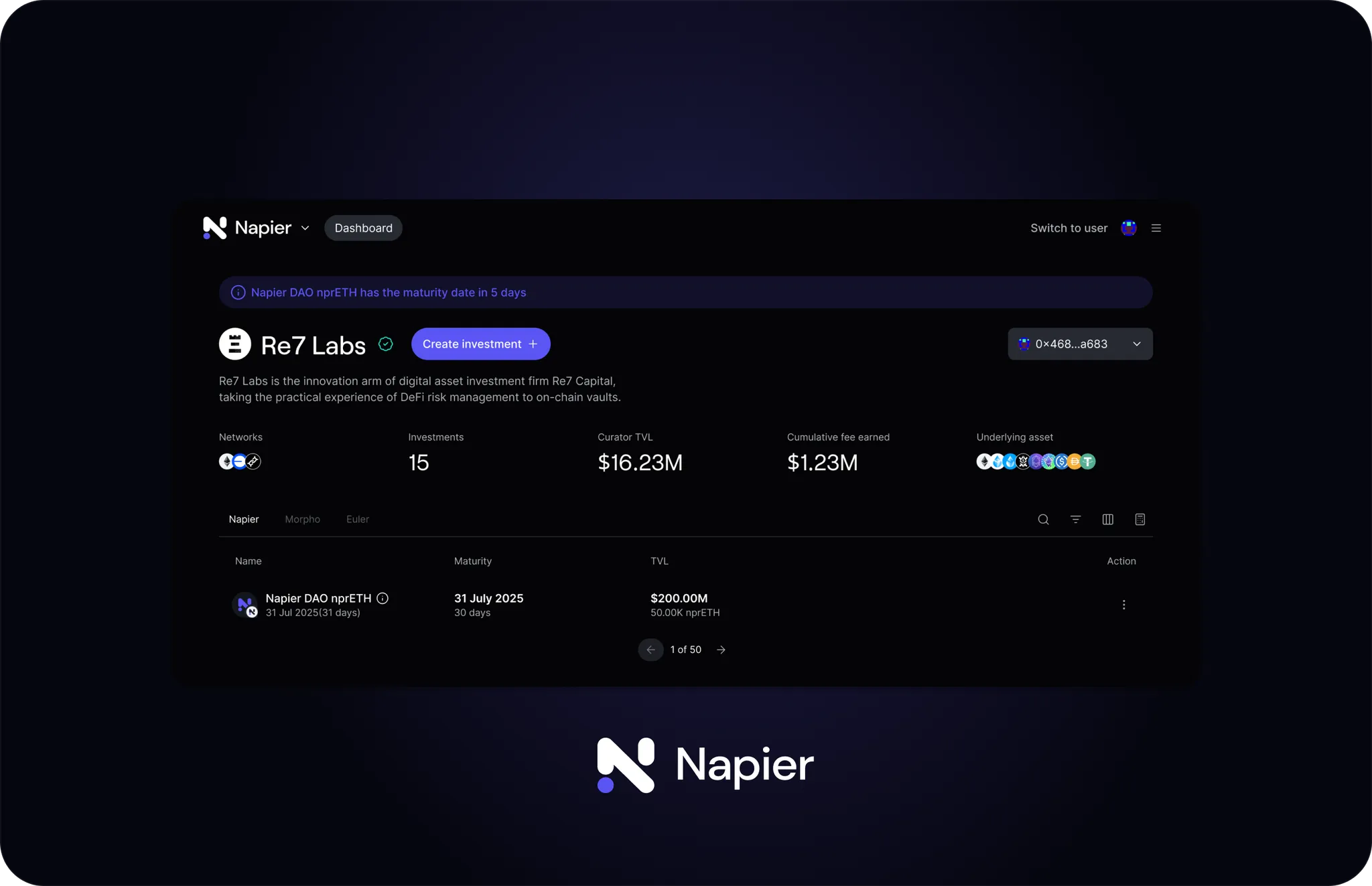

Four months ago, we launched Napier v2—the first initiative to welcome curators into the yield-tokenization arena. With our no-code Napier Resolver template kit, the community could permissionlessly deploy PT/YT products for any yield-bearing asset, without additional development. Within weeks, more than 50 white-label markets came online, propelled by strong community engagement. Blue-chip curators such as MEV Capital and Re7 joined on day one, lifting TVL to roughly $50 million.

Alongside this rapid adoption, the community’s feedback was clear. We listened—and we’re listening to their feedback and working to improve the product:

-

Price Impact

The large price impact during trades impedes PT’s use in DeFi, especially for collateralization.

-

AMM Curve

The current AMM curve isn’t optimized for the time-dependent accrual of yield on fixed-term assets

-

Order Flow

Order flow is limited to the Napier UI.

-

Limited differentiation and monetization

Under the current stack, curators have limited ways to differentiate their strategies and generate revenue.

Constraints of Yield Tokenization

It’s also clear there are sector-wide issues—and we believe they need to be addressed:

-

Fragmented Liquidity

When capital is split between the AMM and other DeFi protocols, liquidity fragments—driving up slippage and fees, duplicating bootstrap incentives, lowering per-unit returns, and muddying price signals.

-

High Liquidity Costs / Low Capital Turnover

Static liquidity provisioning forces protocols to shift costs onto LPs or token issuers—or inflate tokens to compensate.

-

Unreliable Pricing

Shallow pools relative to total PT supply undermine price discovery and leave users unable to trade until maturity.

Napier AMM Features

With Napier AMM, combining a Notional-style trading curve with Uniswap v4’s foundation creates a cohesive, shared-liquidity network across DeFi—including yield tokenization—delivering an industry-leading trading experience and efficiency:

-

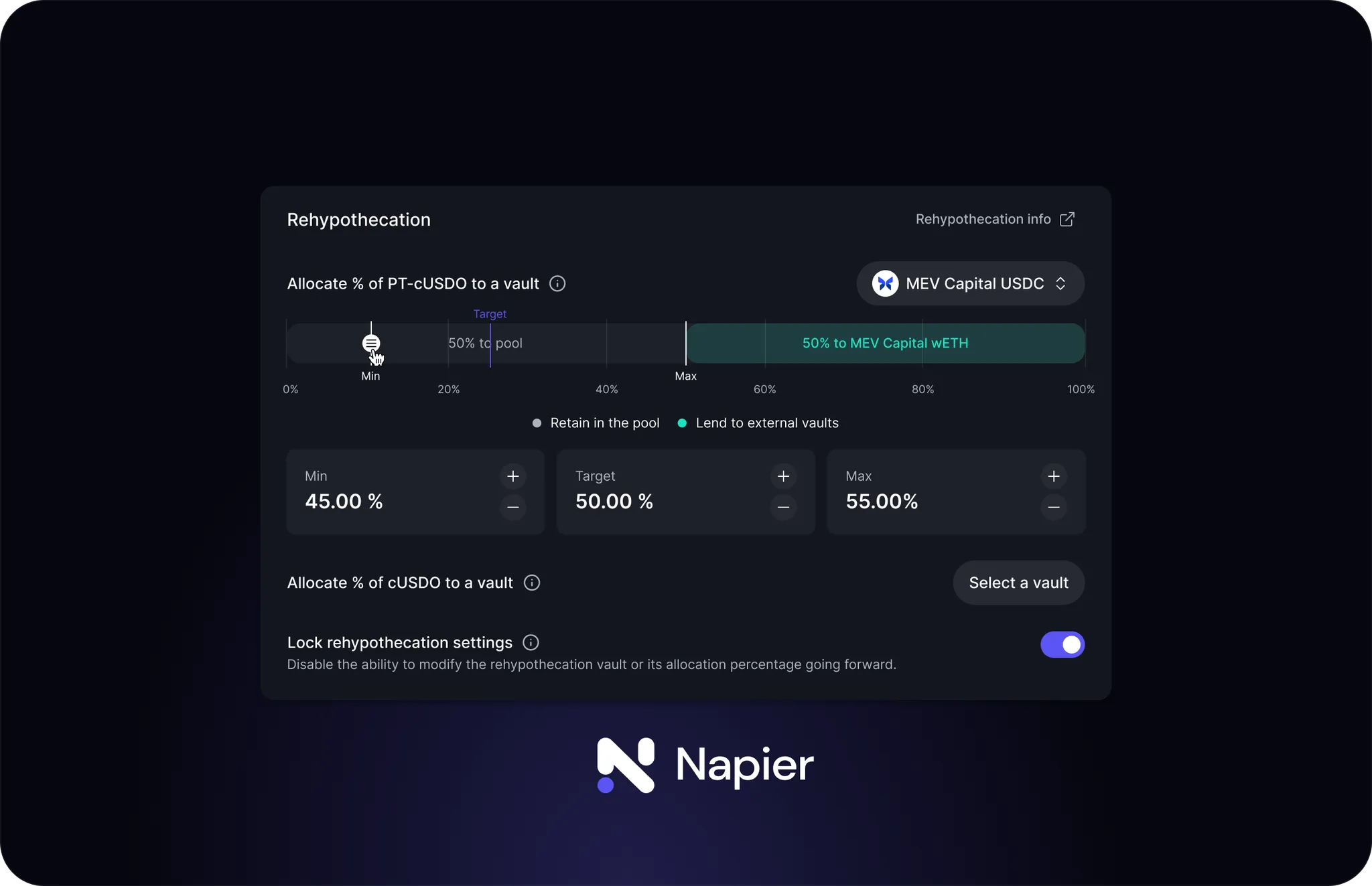

Rehypothecation

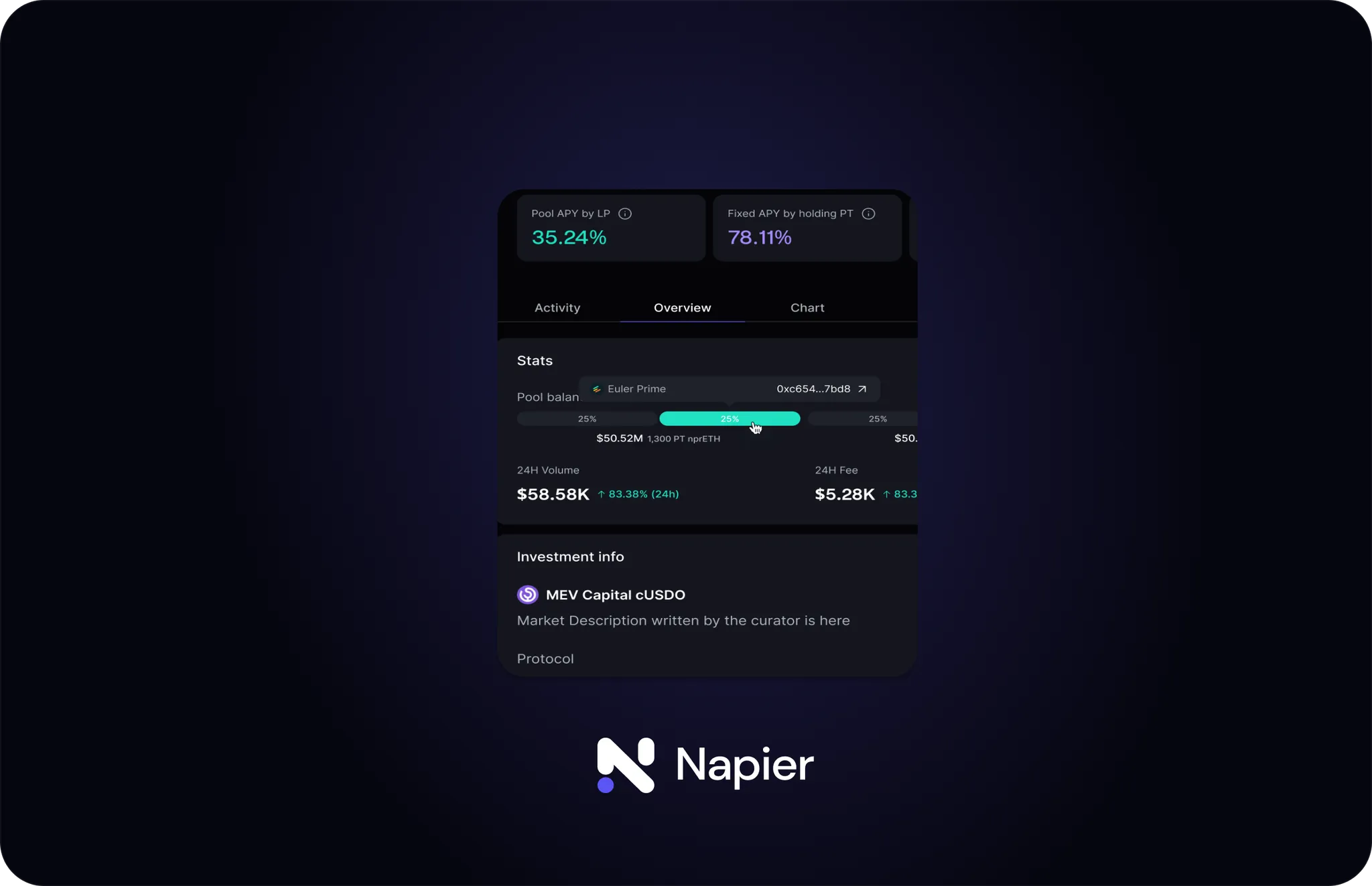

LP capital can be deployed into ERC-4626 vaults while remaining fully tradable—unlocking dual yield (vault returns + trading fees) without freezing liquidity.

-

JIT liquidity

On-demand depth via dynamic AMM↔vault rebalancing during PT/YT trades: fewer idle reserves, lower slippage, and less liquidity fragmentation across DeFi integrations.

-

Time-adaptive curve

Curves evolve with time-to-maturity, aligning price with accrued yield and sharply reducing LP value leakage from arbitrage—so depth stays usable closer to expiry.

-

Concentrated liquidity

Liquidity is focused into bespoke implied-APY bands, matching each market’s risk/vol profile to maximize capital efficiency and minimize price impact.

-

Curator-set parameters

Curators define vault allowlists and allocation ratios, fee splits, and APY bands calibrated per asset—enabling differentiated strategies and business models.

-

Uniswap v4 compatibility

Built as a v4 Hook for direct integration with Uniswap routing and solver networks, with portable deployment across every chain where v4 runs.

Universal Benefits of Napier AMM

Napier AMM is built for you.

Benefits for Curators

- No need for dedicated static liquidity commitments for yield trading

- Custom concentrated liquidity across arbitrary implied APY bands

- New revenue stream for curators via AMM trading fees

- Improved capital turnover of deployed assets

- Whitelist control enabled through KYC Hooks

Benefits for LPs

- Zero impermanent loss through time-adaptive curves

- Improved capital efficiency via implicit APY bands

- No need for dedicated static liquidity commitments for yield trading

- Dual yield structure: standard LP returns plus vault yield

Benefits for PT/YT Traders

- Stronger resistance to price impact

- Deeper liquidity through shared capital between AMM and lending vaults

Benefits for Asset Issuers

- Liquidity bootstrapping without excessive incentive spend

Securing Napier

Security remains our top priority. As we prepare for launch, the Napier team is following a rigorous process to ensure security and reliability. Through the Uniswap Foundation Security Fund, we’re working with top-tier auditors and independent experts and meeting the industry’s highest standards.

When Napier AMM

Napier AMM is slated to roll out across every chain running Uniswap v4. Rigorous audits are underway in coordination with the Uniswap Foundation Security Fund, and we’re concurrently onboarding curators and asset issuers. We’re targeting an October launch, which we believe will push the sector’s frontier.

Napier AMM Complements Napier V2

Napier AMM was built to complete the final piece missing from Napier v2. We aim to overcome the limits of legacy yield-tokenization protocols and establish the standard for on-chain yield derivatives. Featuring rehypothecation, curator-defined parameters, concentrated liquidity, and time-adaptive curve dynamics, Napier AMM delivers institutional-grade flexibility and security—and drives the further expansion of the tokenized-yield market.

This is only the beginning. Join us—and let’s redefine the future of finance together!